28+ hard money loan vs mortgage

Open-end and closed-end loans unsecured and secured loans student loans mortgage loans payday loans. Meanwhile commercial mortgages from banks usually keep an LTV ratio of 80 percent.

How To Use Hard Money Loans To Finance House Flipping Reflipper Net

Web A hard money loan refers to asset-based financing where the borrower receives funds that are secured by real property.

. Web The interest rates charged for hard money loans are also usually much higher than for mortgages auto loans or other types of financing. If youre interested in this type of financing LendingTree is an online lending marketplace that allows you to choose from multiple loan offers. Web Mortgages are secured loans that are specifically tied to real estate property such as land or a house.

Hard money loans are created for real estate investors looking to fund short-term investments. Web Compared to a hard money loan investment property financing can be more difficult to qualify for. Hard money loans can also be more expensive depending on the preferred loan-to-value LTV ratio of the lender.

This requirement can make all the difference to a borrower with high debt ratios. Pros One advantage to a hard money loan is the approval process. Web In May 2022 the average rate on a conventional 30-year fixed-rate mortgage was 509 according to Freddie Mac.

Hard money lending is especially popular for the following people. Web Hard Money Loan vs Mortgage Hard money and mortgage loan are two confusing terms with different purposes to fulfill. Web Marquee offers 2nd mortgage hard money loans up to 60 back-end DTI.

Hard money loans can have much higher interest rates often 8 15. A hard money loan is likely to have a much higher monthly payment because youre expected to repay it within around three years time at the most. Hard money loans are often used to make money and not as a way to find a place to live.

Many hard money lenders have developed negative reputations for inconsistent service. In most cases private investors are the biggest lenders of hard money loans and they are considered difficult to acquire. This can happen two ways.

Homeowners will be offered better rates and terms than those seeking hard money for their home. The former helps expand a business while the other is a loan that lets home seekers buy a house. Most hard money lenders for real estate investing companies and individuals process applications for financing in a matter of weeks making it easier for investors to get money quickly.

While mortgage rates are lower because theyre taken over a longer time period and come with less risks. The lower LTV means hard money lenders do not provide as much financing as traditional commercial sources. But this convenience comes with higher rates and fees.

Web There are pros and cons to hard money loans related to the approval process loan-to-value LTV ratios and interest rates. Web Most hard money lenders follow a lower loan-to-value LTV ratio which is 60 percent to 80 percent. A hard money loan may also have a balloon payment at the end.

Since these types of lenders can essentially be anyone they may not be the as experienced as hard money lenders. Web Hard money loans are the opposite. Hard Money Loans are not for those seeking traditional mortgages for their homes.

If you have a business you can use the money from the loan to buy a new property for your company. Web One advantage of a typical 15- or 30-year mortgage is a lower monthly payment. Web Most of our loans are interest only which means a fixed interest is paid throughout the term and the full balance at maturity.

For example a 100000 with 12 monthly terms and 9 rate will yield 12 monthly payments of 750 and a final payment of 100000. The terms can vary and are usually determined by you and the private money lender. Web A hard money loan is much easier to acquire than a conventional loan.

Private lenders have their own requirements for borrowers and are focused on the merits of the deal and if it makes sense overall rather than. Hard money loan rates are much higher and you borrow the money for only a short period of time. Hard money finance is used when real estate investors have a property to be worked on and renovated for further sale.

Higher credit score Similar to all forms of debt making regular on-time payments can help improve creditworthiness. The property is owned by the borrower in exchange for money that is paid in installments over time. Web Because mortgage loans are insured by the home youre purchasing youll usually get a relatively lower interest rate than you would with personal loans.

HELOCs usually take 30-45 days to close while a 2nd hard money mortgage usually takes 10 days for consumer purpose and 7 days for business purpose. Also unlike a traditional mortgage the value. Web Hard Money vs Soft Money Rates.

Web Hard money loans are short-term loans designed to help investors finance their real estate purchases quickly. However rates can be very competitive usually in the range of 5 and 8. Web The flip side.

Web Unlike hard money lenders these types of loans do not have a general set of guidelines or criteria. Hard money loan rates are anywhere between 6 and 12 generally. Web Hard money loans and mortgage loans differ when it comes to purpose.

Web Hard money loans have higher interest rates because they pose a higher risk for lenders and theyre shorter. With a hard money loan the approval and qualification processes are faster compared to other types of loans with an approval decision coming in the same day.

Hard Money Loan Vs All Cash Offer

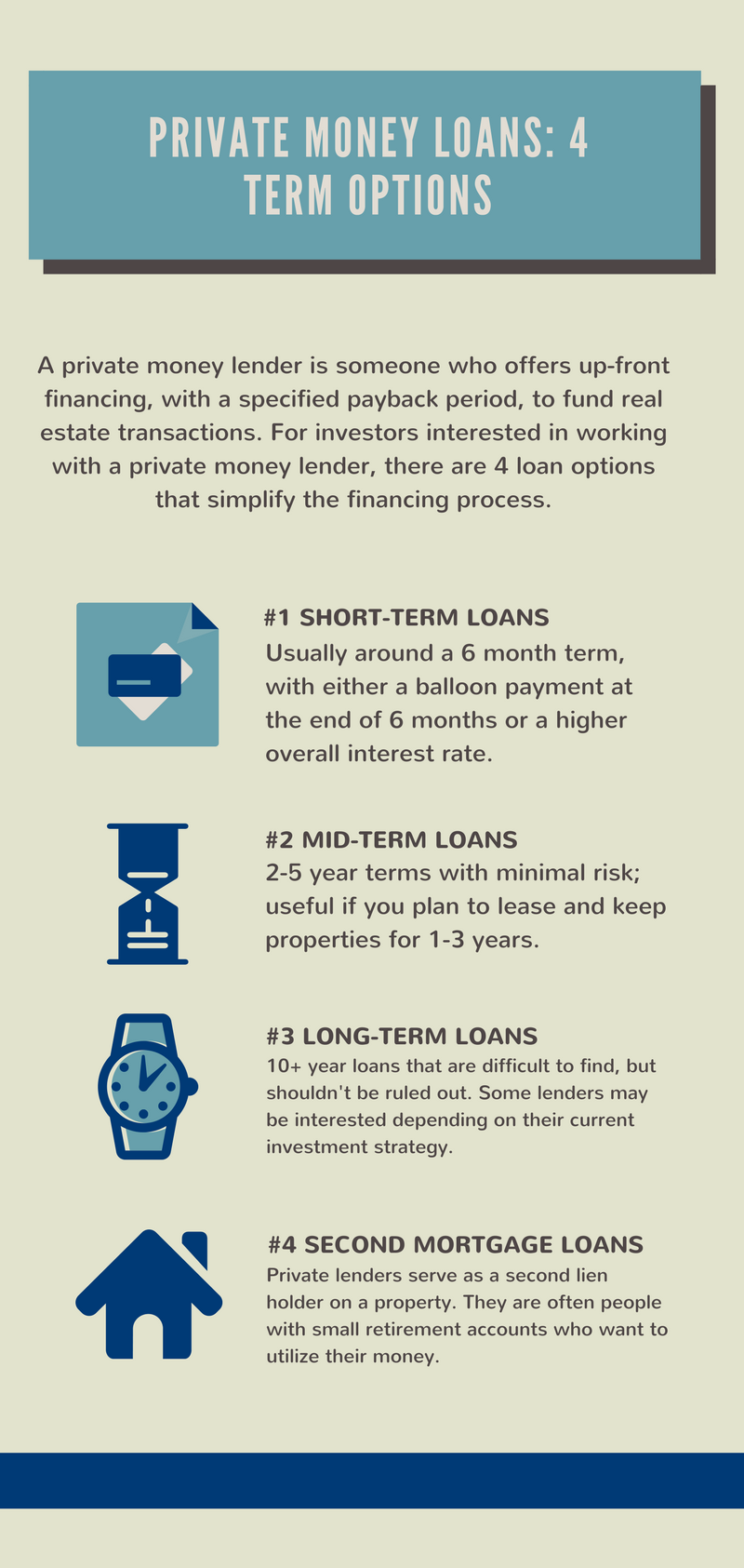

The 4 Most Common Loan Term Options For Private Money Loans

Hard Money Loan Vs Mortgage Key Differences Explained

25 Best Mortgage Brokers Near Peachtree Corners Georgia Facebook Last Updated Mar 2023

How Do Hard Money Loans Work Nav

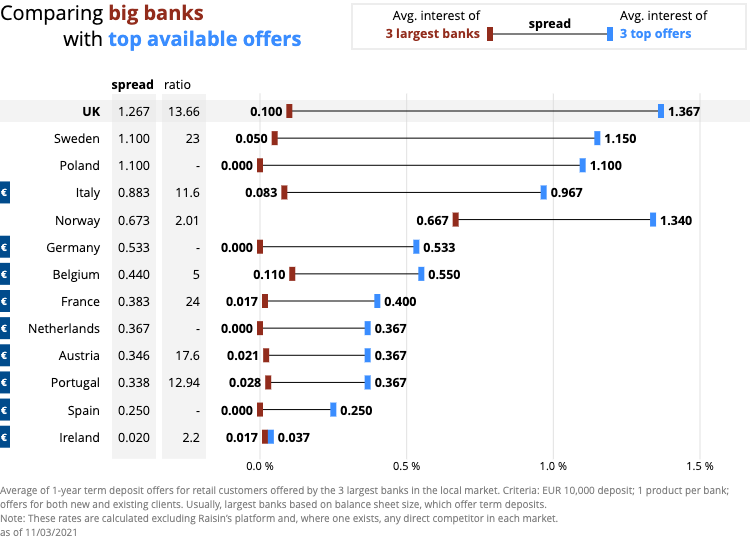

Interest Rates Explained By Raisin

Real Estate Investing How A Hard Money Lender Can Help Longhorn Investments

Natalya Hill Senior Mortgage Loan Officer And Reverse Mortgage Planner Fairway Independent Mortgage Corporation Linkedin

Private Money Lenders How Private Money Loans Can Benefit Real Estate Investors

Difference Between Hard Money Loans V S Traditional Loans Private Capital Investors

How To Choose A Mortgage Or Hard Money Lender

Mortgage Broker Geebung Aspley John Meade Mortgage Choice

Venkatesan Ramasamy Bank Employee Hdfc Bank Limited Linkedin

Hard Money Loan Vs All Cash Offer

Hard Money Loan Vs Mortgage Key Differences Explained

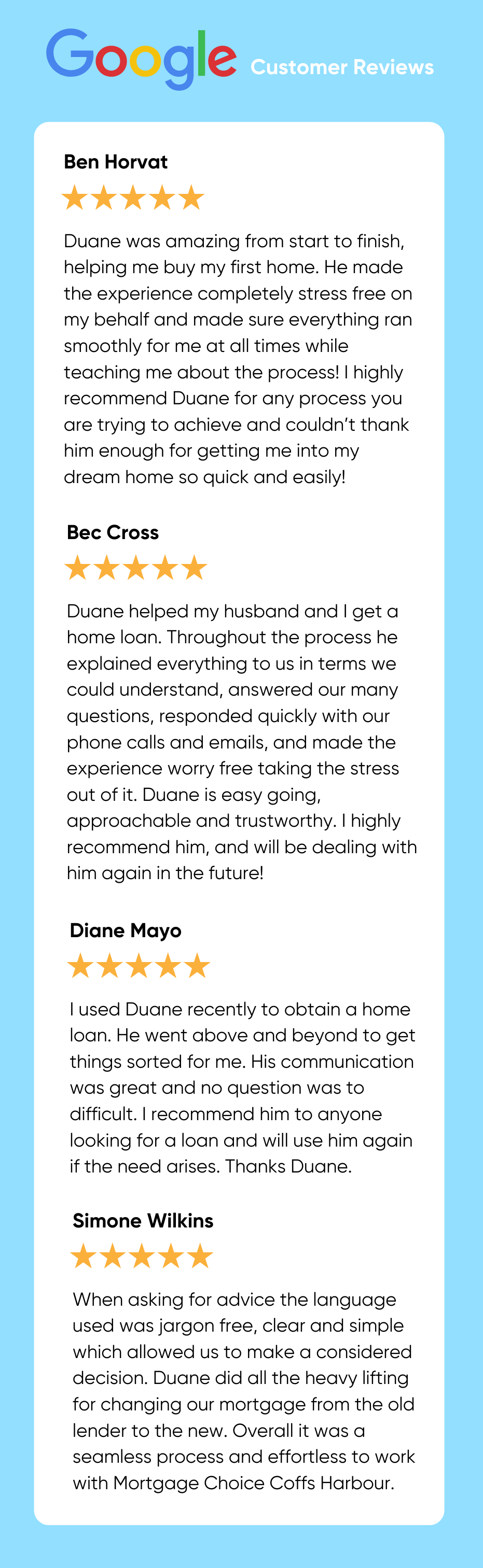

Mortgage Broker In Coffs Harbour Sawtell Woolgoolga Mortgage Choice

Differences Between A Hard Money Loan Vs A Mortgage Loan