28+ Flexible mortgage calculator

The calculated results will display the monthly installment required to pay off the loan within the specified loan term. Microsoft Excel Mortgage Calculator With Extra Payments Subject.

Not Able To Qualify For A Traditional Mortgage Loan Our Private Lenders Can Help

The mortgage balance shown on the graph and table are the same and are the amount left on the mortgage at the end of that particular year.

. Based on a repayment mortgage. All the repayment info shown is based on current rates - but rates change and these numbers should be treated as rough estimates only. 2836 are historical mortgage industry standers which are.

This result is based on taking out a ME Flexible Home Loan with a rate of 369 pa. Assuming you have a 20 down payment 140000 your total mortgage on a 700000 home would be 560000. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

Open a Flexible Spending Account. Choose this option to enter a fixed loan term. Calculate mortgage payments quickly and easily.

Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. While the final amount will change a bit by the time youre ready to close getting an estimated payoff amount including.

28 44128 19029620730445025 10736432460242781 100 11736432460242781 38074238225573549 79290086376854265 18991546492219451 22777475810874392. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 2515 monthly payment. We offer payment schedules and options to fit your lifestyle and goals. Includes extra payments option.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. For instance the calculator can be used to determine whether a 15-year or 30-year mortgage makes more sense a common decision most people have to make when purchasing a house. Interest is calculated daily and added monthly.

They both need a front-end DTI ratio of 28 percent and a back-end DTI ratio of 43 percent. Were proud to offer competitive rates to our mortgage clients. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time.

When it comes to calculating affordability your income debts and down payment are primary factors. Any regular monthly overpayments remain the same over the term of the mortgage. All years are of equal length.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. We are dedicated to helping our clients reach their home buying dreams. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

And qualified military spouses. Factors that impact affordability. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

By default this calculator uses a 28 front-end ratio housing expenses versus income a 36 back-end ratio monthly housing plus debt payments versus income though these are variables in the calculator which you can adjust to suit your needs the limits set by your lender. Across the United States 88 of home buyers finance their purchases with a mortgage. A flexible spending account FSA is a tax-advantaged account that is usually offered by employers to their employees so they have the ability to set aside some.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Active-duty members and veterans can qualify with a credit score of 620. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 431 monthly payment.

A Partner You Can Trust. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. 1 472 pa.

If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190. It comes with flexible qualifying standards and a zero downpayment option. One of the most important pieces of information youll need is your mortgage payoff amount.

Fixed Rate Mortgage Loan Calculator. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. But to be safe back-end DTI.

While your personal savings goals or spending habits can impact your.

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Loans Website Templates 57 Best Home Loan Private Money Lender Web Themes

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Lemonade Landing Page Design Inspiration Lapa Ninja Landing Page Design Insurance Website Home Insurance Quotes

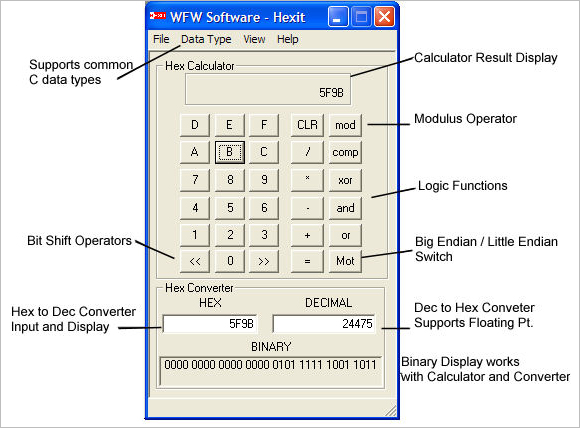

10 Calculator Software Download For Windows Downloadcloud

Several Useful First Time Home Buyer Options And Resources Fha Loans Refinance Mortgage Fha

10 Calculator Software Download For Windows Downloadcloud

Budgetary Slack Ways To Prevent Budgetary Slack

Ryan Wiley Business Card Burlington On Mortgage Brokers Mortgage Brokers Mortgage Home Mortgage

Free Downloadable Desktop Mortgage Calculator Which Given Other Variables Calcula Free Mortgage Calculator Mortgage Amortization Calculator Mortgage Calculator

10 Calculator Software Download For Windows Downloadcloud

10 Calculator Software Download For Windows Downloadcloud

What Is The Difference Between The Kentucky Freddie Mac Home Possible And The Fannie Mae Home Ready Loan Program Fannie Mae Kentucky Home Loans

Loan Syndication How Does Loan Syndication Work With Example

Mortgage Financing Calculator Lead Reslp 8 Mortgage Responsive Landing Page Design Preview Mortgage Amortization Calculator Mortgage Refinance Mortgage

Sports Arbitrage Calculator Excel Template To Calculate Odds And Stakes Arbitrage Betting

Positive Negative Reviews Roundup App By Roundup App Finance Category 9 Similar Apps 138 Reviews Appgrooves Save Money On Android Iphone Apps